New Record In Upper Lonsdale; Second Highest Price Ever and Highest PPSF

Posted on Nov 26, 2023 in Real Estate

Recent sale in Upper Lonsdale was the second highest price of all time with a sale price of $5,000,000; second only to another new home sold in 2019 that sold at $5,320,000.

The part that is record breaking is the price per square foot at this price range. The highest price homes located on St. Pauls Avenue had 6,946 square feet and a sale price per...

Upper Lonsdale Average Sale Price Just Over $2.3M; 10 Year Sale Price Comparison

Posted on Nov 08, 2023 in Real Estate

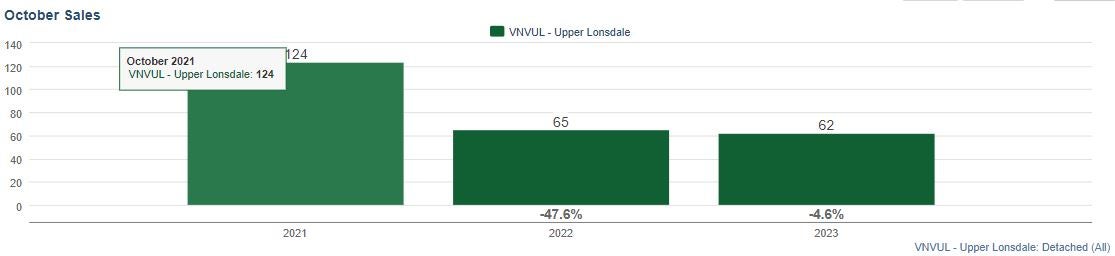

Sales in 2021 were very high, with the second highest volume of sale in Upper Lonsdale over the past 10 years. Sales for the area over the past ten years averaged 101.29 sales per year. 2023 Upper Lonsdale sales will likely be roughly 30% below the ten year average.

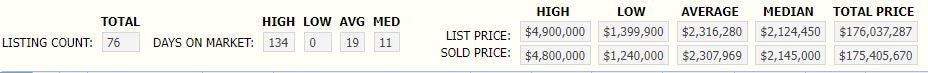

In 2022 there were 76 detached home sales with an average sale price of $2,307,969.

I...

5 Year Mortgage Rates Expected To Decline Early 2024

Posted on Nov 02, 2023 in Real Estate

Post shared from Real Estate Board Chief Economist...Highlights

- Bank of Canada tightening sends mortgage rates to 15-year highs

- Are high rates finally impacting economic growth?

- How far will fixed mortgage rates fall once the Bank of Canada lowers its policy rate?

Mortgage Rate Outlook

Mortgage Rate OutlookHotter than expected spring inflation and a resurgent housing market...

When Variable Rates Are Higher Than 5 Year Fixed Rates; Expect Interest Rate Drop

Posted on Oct 26, 2023 in Real Estate

I thought you would appreciate this email that was sent to me by one of my mortgage brokers. If you are looking to buy or refinance, the following should give you insights to bank expectations on rates. I have already posted (last month blog) about how rates are expected to drop over the next two years by up to 3%. Banks want you to lock in on the...

Can You Buy With a 5% Down Payment in British Columba, Canada?

Posted on Oct 23, 2023 in Real Estate

This information was pulled direction from CMHC's website (click here or above photo to view)...

What are the general requirements to qualify for homeowner mortgage loan insurance?

Find out which requirements you must meet to qualify for CMHC's Homeowner Mortgage Loan Insurance.- Th

e home is located in Canada.

The purchase is not subject to any prohibit...

Home Purchase Cost Outline

Posted on Oct 23, 2023 in Real Estate

When buying a new home there are costs you need to consider.

DEPOSIT

You will need an initial deposit to secure your property. This is usually between 5% and 10%. There are always exceptions where it could be higher or lower.

DOWN PAYMENT